The recent rule being considered by the Securities and Exchange Commission to allow the New York Stock Exchange to establish “Natural Asset Corporations” was recently defeated and CFACT Driessen Fellows played a part in bringing down what many critics said would be a disaster for the United States. One critic, Utah State Treasurer Marlo Oaks, said about the proposed NACs, “private interests, including foreign-controlled sovereign wealth funds, could use their capital to purchase or manage farmland, national and state parks, and other mineral-rich areas and stop essential economic activities like farming, grazing, and energy extraction.”

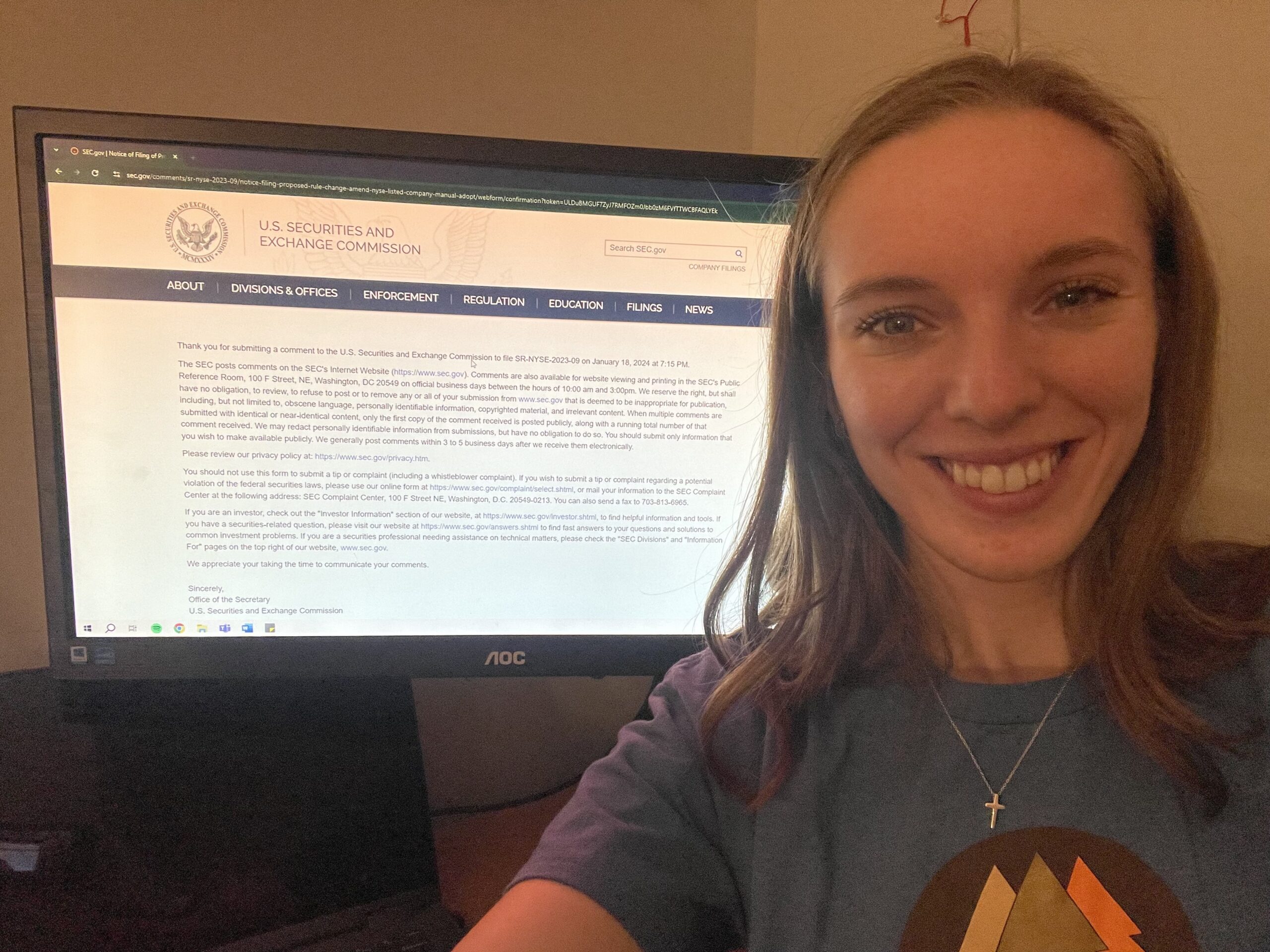

After receiving innumerable letters of opposition, including the letter below from Liberty University Driessen Fellow Julia Heath, the SEC announced it would be withdrawing the rule change proposal. After the agency’s announcement Julia Heath said, “This is a great victory and exactly why we get involved with CFACT. CFACT teaches young people how to make a real difference.”

Julia’s letter:

“I am opposed to the new SEC proposed rule change to amend the NYSE listed company manual to adopt listing standards for natural asset companies. The impact this would have on economically essential activities such as grazing, mineral extraction, and modern agriculture is concerning. This proposed rule could also put a stop to recreational access as well.

The overarching theme that this rule supports is the control of the nation’s natural resources, which leaves the door open to many security risks, one of these risks being the possibility of natural asset companies located in hostile nations that contribute funding taking control of these resources. Another side effect of this proposed rule would lead to the economic valuation of natural processes such as the provision of clean air and water through biological systems.

Stockholders in any of these companies would be contributing funds to buy up access to natural resources. This could prevent the usage of land for necessary community functions. Natural resources that are currently available for use by the general public will be monetized. The only beneficiaries of this policy would be the natural asset companies. If people are forced to offset their carbon footprint, this could pose a significant disadvantage for those who face greater financial disparities.

Additionally, natural asset companies ban industrial agriculture, which is a worldwide practice. Industrial agriculture is how food is produced to feed the population. The effects of this idea have already taken place in Sri Lanka, where the harvest of rice decreased by 40-50%, leading to an 80% price increase, and subsequently civil unrest. Another consequence of this rule could be the disallowance of cattle grazing on land owned by the Bureau of Land Management. Farmers currently pay a fee to be allowed to have their cattle graze the open land that is owned by the Bureau of Land Management. This could also affect those with property inside designated areas, which would cause private individuals to face various restrictions in relation to their property.”